If you’re considering to start a property management business or are already managing real estate, there’s one crucial aspect you should know: AML compliance. The spread of money laundering goes much beyond banks.

Real estate transactions have become an increasingly popular way to conceal and legitimately transfer illicit funds. If you don’t have the proper checks in place, your company might take part in criminal activity.

The real estate sector deals with high-value transactions and complicated ownership structures, which makes it a prime target for money laundering. Governments are enforcing AML rules, and every participant, even the field service team members, are accountable for conformity. It’s not only about avoiding penalties. It’s about ensuring your company’s security and contributing to a more secure property market.

What Is AML?

The term “Anti-Money Laundering” (AML) is a term used to describe the policies and procedures that prevent criminals from hiding illegal money within legitimate transactions. In the real estate industry, this is verifying the authenticity of sellers and buyers and tracing the source of money, and reporting anything that is suspicious to the proper authorities.

Ready to get started with Field Promax?

Why Criminals Target Real Estate?

Real estate appeals to money-launderers for a variety of reasons.

- Large transactions: One property purchase can clean millions in a single move.

- Hidden buyers: Shell companies and nominee owners make it difficult to identify who is really behind the deal.

- Slow processes: Real estate deals take time, giving criminals room to layer and disguise the funds.

- Appreciating value: Once the black money is used to buy a property, the asset can grow in value, adding profit to the crime.

These elements make real estate an effective instrument for laundering money. If there aren’t any adequate safeguards, the transactions could go unnoticed until it’s too late.

How Money Laundering Happens in Property Deals?

The strategies used by the fraudsters often seem ordinary on the surface:

- Nominee ownership: A different individual signs the document to conceal the true buyer.

- Layered payments: Money is transferred through various businesses, banks, or accounts to conceal its source.

- Reinvestment and sale: The property is then used to rent or sell it again to make the money appear legitimate.

If you’re not well-trained to recognize such patterns, they could be easily overlooked. This is the reason AML procedures should be a crucial and integral part of every real property transaction.

Global AML Trends and What They Mean for Field Service Teams

In the world, authorities are taking steps to prevent money laundering in real property. Laws are being amended and data sharing is increasing, and transparency has become the top priority. Professionals in the field of property aren’t viewed as passive observers. They play an active role in identifying financial crime.

The Role of FATF

The Financial Action Task Force (FATF) is an international body which sets standards across the globe in AML compliance. Its mission is to assist governments to close loopholes, impose stricter regulations, and ensure that their financial systems are in good order.

Some of its main focus areas include:

- Requiring real estate transactions to disclose the true owners behind companies and trusts

- Pushing countries to create stricter AML rules for property purchases

- Flagging countries that fail to meet minimum compliance standards

This is making it more difficult for criminals to conceal money through real estate transactions and making it easier for professionals to identify the potential risks.

Examples of Country-Level Action

The government is putting pressure on property professionals through new laws. A few standouts include:

- United States: The Corporate Transparency Act now requires companies to report their real owners to a federal database.

- United Kingdom: The Register of Overseas Entities forces foreign companies that own UK property to declare their beneficial owners.

- European Union: Updated AML directives require stricter identity checks and give the public access to ownership records.

What does this mean for Property Management?

If you’re employed in property management. Here’s what you’re expected to accomplish:

- Verify identities: Be aware of who you’re doing business with, and verify the authenticity of all documents.

- Know ownership: Find who the owner of the trust or company is associated with the transaction.

- Documents: Store the client’s information, contracts, and other documents for five and seven years.

- Report concerns promptly: If any activity appears suspicious, follow the legal procedure to report it right away.

In the event of a failure to follow these steps, it could result in fines or legal issues and also lead to the cancellation of the business license.

Key Steps in AML Compliance for Property Transactions

AML compliance in real estate is not a one-time requirement. It’s a process that begins before closing and continues for a long time after the deals are done. Each step is crucial because risks could be identified at any time in the process.

Step 1: Client Verification ( Customer Due Diligence)

The first step in AML checks in real estate is client verification. Before signing any document, professionals must confirm the identity of each individual and company involved.

Here’s what you need to check:

- Full names, addresses, and official IDs

- Proof that the seller owns the property

- If a company or trust is involved, identify the Ultimate Beneficial Owner(UBO)

- Run names through international watchlists and databases

- Screen for Politically Exposed Persons or those with known criminal ties

If a person refuses to cooperate or tries to cover up an outside party, it’s an indication of trouble. Make a report.

Step 2: Monitoring Transactions

Just because the deal has started doesn’t mean the risk is gone. Look out for patterns or changes that don’t make sense.

The red flags are:

- Large payments are made in cash

- Third parties are involved without a clear reason

- Vague or missing financial documentation

- Attempts to skip steps in the verification process

You should also be alert for odd payment schedules or sudden shifts in who is handling the money. If anything feels off, pause and investigate.

Step 3: Ongoing Oversight

AML obligations do not stop once the contract is signed. You must be vigilant until the transaction is completed.

Ongoing compliance process includes:

- Observing how the property is used post-sale

- Noting any quick resales, odd renovations, or unexplained subleasing

- Keeping all documents safe and accessible for audits, usually for five to seven years

- Reporting anything suspicious that comes up during service visits or inspections

Field service teams typically find the problems first. If something doesn’t look right during a job, report it right away.

Why Field Teams Matter in AML Compliance

Field service professionals are not just task-completers. They’re often the first person to interact with clients, and even the first to recognize when something is odd.

- You observe the property before others do

- You interact directly with clients and collect key documents

- You can catch mismatches between what you are told and what you see.

What Could Go Wrong if You Miss It?

- Your company could face financial penalties

- Licenses may be suspended or revoked

- Legal action could follow, even for honest mistakes

- The company’s reputation might cause long-term damage

Why Your Role Helps the Industry?

If you follow AML rules carefully, you contribute to a more secure, safe property market. Your actions protect your team, your clients, and your business from serious risks.

How Technology Strengthens AML Compliance?

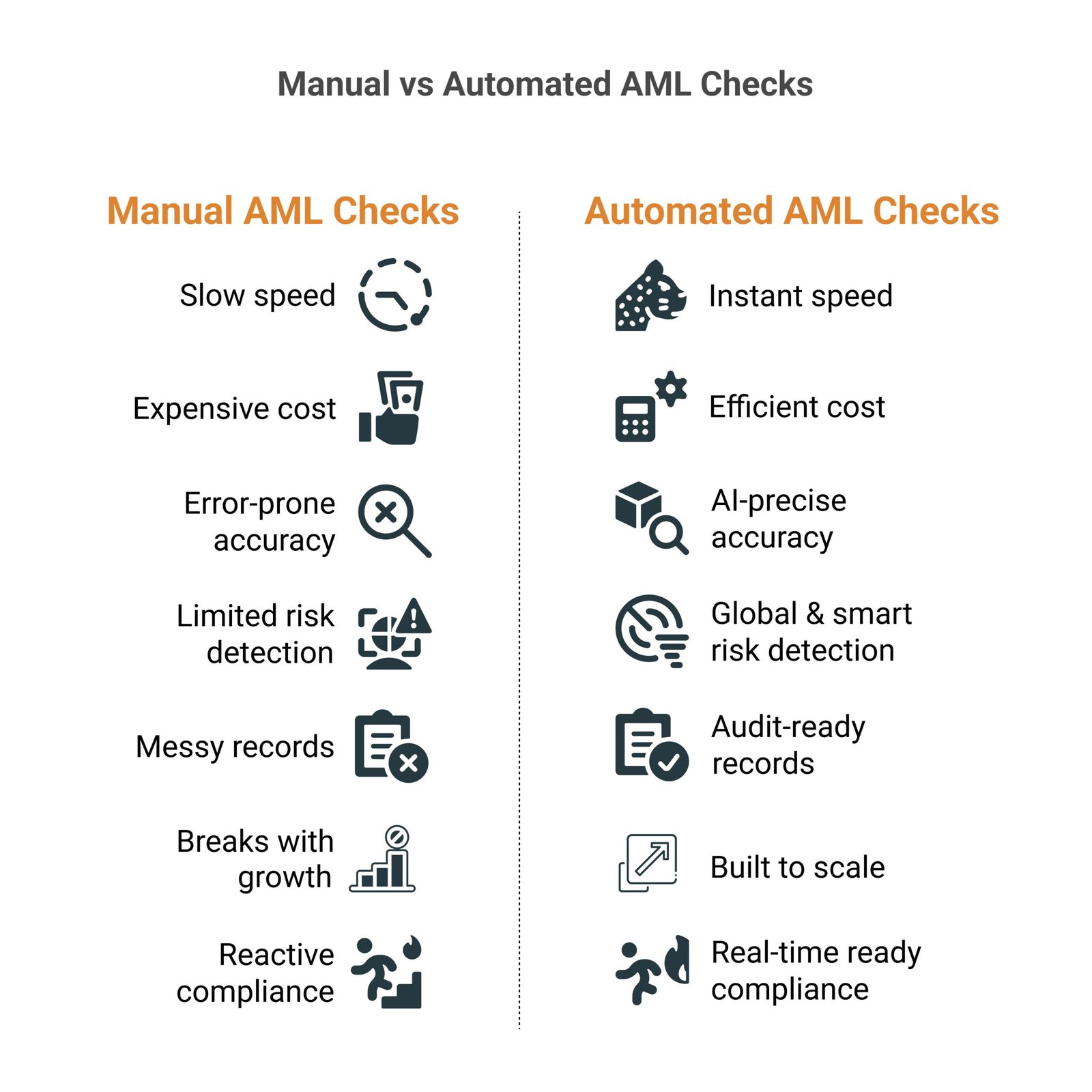

Modern tools allow you to adhere to AML rules without causing delays to your process.

Automation Helps

- Verifies IDs instantly

- Flags the missing or expired documents

- Compare names with watchlists

- Tracks ownership of the company through layers

Smart Analytics Catch What You Miss

AI can detect:

- Unusual payment patterns

- Deals that are priced well above or below the market value

- Connections between sellers and buyers that hint at hidden links

Mobile Tools for Field Teams

Cloud platforms and apps now enable teams to:

- Upload documents securely

- Record GPS-tagged visits

- Receive instant alerts for missing compliance steps

- Keep digital records ready for audits

Tools such as real-time dashboards bring these features together, ensuring your team is organised and ready for audits with no additional documentation.

Best Practices for Staying Compliant

Keep your property field team in line with AML guidelines by following the few methods below:

- Train regularly on how to spot red flags

- Use the right tools, like mobile apps with secure uploads and tracking

- Report concerns quickly to a manager or compliance officer

- Reward smart decisions in the field to build a compliance-first mindset

Conclusion

Real estate is highly protected from financial crime because of AML checks. Because of tougher regulations, evolving criminal methods, and greater public awareness, the property industry must respond appropriately. Real estate professionals who follow AML rules in all their business dealings protect their company and make the market more open and trustworthy.

Because regulations are always changing, being up-to-date and reacting promptly is necessary. Field Promax supports this by offering real-time dashboards, automated alerts, and centralized record-keeping, helping teams stay prepared and responsive as requirements shift.

Firms that invest in education and technology are more likely to stay compliant and competitive in a rapidly evolving market.

Originally Published at – Field Promax (AML Compliance in Property Services)