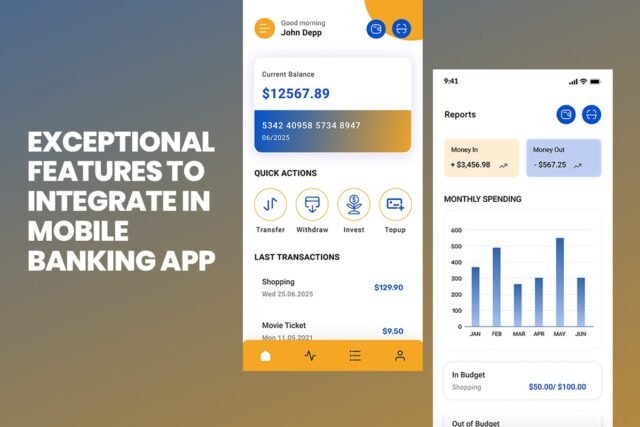

The mobile bank revolution quickly changes financial services. With an increase in the use of smartphones, the demand for rapid, safe, and intelligent banking experiences increases. By 2025, Mobile Banking will no longer be a luxury but will be an important channel for banks to operate and maintain technology-loving customers. In order to remain competitive, financial institutions must offer innovative, customer-focused features that are not limited to looking at the remaining amount or transferring money.

Whether you are a Fintech start-up or a traditional bank looking to modernize, this article emphasizes top features to include in the Mobile bank app in 2025. We will also explore the trends, technologies, and best practices of the current industry to create an app ready for the future.

1. It must be secure with multi-factor authentication & biometric login

Security is the basis for any bank application. In 2025, mobile banking apps are expected to support biometric authentication methods such as fingerprint scanning, face recognition, and voice. Multifactor authentication (MFA) further enhances safety by requiring two or more verification methods, such as a password and OTP or biometric scans.

Bank behavior also uses biometrics, analyzing user behavior (writing speed or swab patterns) to detect deviations and prevent unauthorized access.

Collaborating with an experienced app development company in India can help you integrate advanced biometric and cybersecurity protocols. These companies often provide customized, scalable, safe, and regulatory transport solutions for financial institutions.

2. Integrate instant virtual assistants and AI-powered chatbots

AI-operated chatbots are revolutionizing how users interact with banking services. These virtual assistants provide 24/7 support, answer questions, help in transactions and even provide personal financial advice. In 2025, Bank Chatbots are expected to be smarter, capable of natural interactions, and able to understand customer feelings through emotional analysis.

Advanced Natural Language Processing (NLP) enables robots to help users in many languages, like catering to global and regional markets. Some apps also support voice-based commands for hands-free banking.

3. Include unique features of smart budgeting and creating insight filters

Today, users expect more than transaction facilities. Integration of AI-operated financial planning units in the banking app adds much more value. This equipment can make:

- Analyze the consumption habits

- Treat cash flow

- Provide budget recommendations

- Suggest saving goals

- Send notifications for unusual transactions

By taking advantage of data and machine learning, banks can actually provide individual insights that help customers make informed financial decisions. This level of adjustment increases the user’s workload and storage requirements.

4. Integrate NFC and features for payments with QR codes

Cashless and contactless payments in 2025 are ideal. Your app will support QR code-based payment and NFC (near field communication) technology for seamless transactions in the store.

Users can scan the QR code to pay traders or immediately transfer money to peers. NFC enables Tap-to-PEA features similar to Apple Pay and Google Pay. These properties are especially important in areas where the use of QR codes is widespread, such as parts of Asia and Europe.

When planning to appoint the app developers, make sure they specialize in integrating API and mobile wallet solutions with the right encryption standards.

5. Capability to manage physical and e-cards

Instant management is another important field for mobile banking. Users must be enabled:

- Lock/Unlock Debit or Credit Card

- Determine the consumption limits

- Request a virtual card for purchase online

- Pin and card details remain safe

- Immediately block the stolen/lost card

Virtual cards provide better protection for online shopping by masking the actual card details. By 2025, this feature will not only be good, but a requirement for consumers who are digital lovers.

6. Facility to apply for loans or investment management

Integration of loan application and management functions in your bank app flows out of the lending process for users. Customers can:

- Check your loan eligibility

- Apply for a personal, home, or vehicle loan

- Track Refund Program

- Get instant loan offers based on credit profiles

Similarly, investment management equipment allows users to buy/sell mutual funds, shares, or fixed deposits directly from the app. Apps can provide AI-controlled investment recommendations based on user goals and risk hunger.

Many modern Fintech companies offer these features to attract financial literacy users who want to manage everything in the same place.

A reliable software development company with Fintech expertise can help you initially integrate these modules by ensuring regulatory compliance and users’ privacy.

7. In-app alerts and push notifications are a must have

Notifications and timely alerts are crucial for banking apps. They play a crucial role in increasing transparency and keeping users informed. Push notifications in your app include:

- Fraud alerts

- Updates about transactions

- Bill payment reminders

- Tailored offers

- Updates about investment performance

Today’s date, allow users to customize notification settings using AI so that they have the control to choose when and how they want to be notified.

Conclusion

By 2025, users’ expectations will be higher than before, and banks must provide state-of-the-art facilities to remain competitive.

From AI-driven insights and voting banking to finance and stability tracking, the above functions represent the future of mobile banking. If you are ready for new and want to lead the future of digital funding,it’s time to hire app developers who understand both business goals and the latest fintech trends.

Choose to hire software developers can be the key to bringing your mobile bank vision to life and distributing the spontaneous digital experiences that meet the needs of 2025 and beyond.

Best bags / shoes replica web. We start service since 2015. rFashionreps.org is a low-cost and high-quality reps bags/shoe factory.